We have been working hard to help bitcoiners acquire more bitcoin in exchange for their fiat. For DCAs and direct deposits, we charge no fees. For one-time or target orders, we offer transparent fee tiers. Now, we are optimizing order routing with our liquidity providers.

How Strike helps customers tap global liquidity 24/7

When you buy bitcoin on Strike, you’re not buying our bitcoin, because we never sell our holdings. Instead, your order is filled by one of our external liquidity providers. These are large market-making firms that supply buy and sell quotes across the Bitcoin ecosystem. Most exchanges and brokerages rely on a shared pool of liquidity filled by the same handful of providers.

Think of liquidity providers as the always-on counterparties that make the market function. If someone is selling bitcoin on one venue, a liquidity provider may step in to buy it, then hedge or offload that position on another venue. They stitch the global market together.

This is what enables your orders on Strike to execute instantly, at any time of day, any day of the year. Without liquidity providers, you’d be waiting for another human to match your trade.

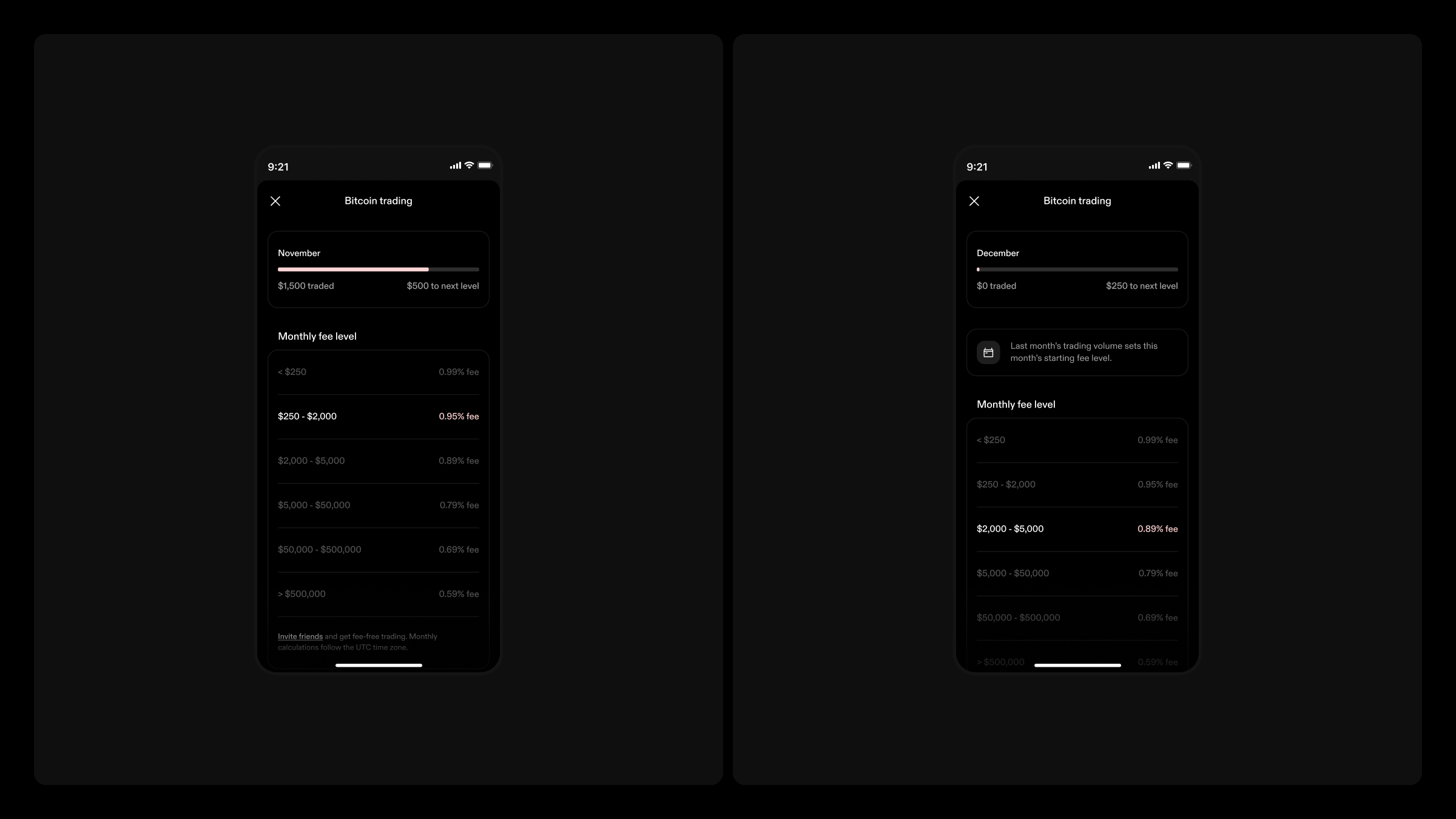

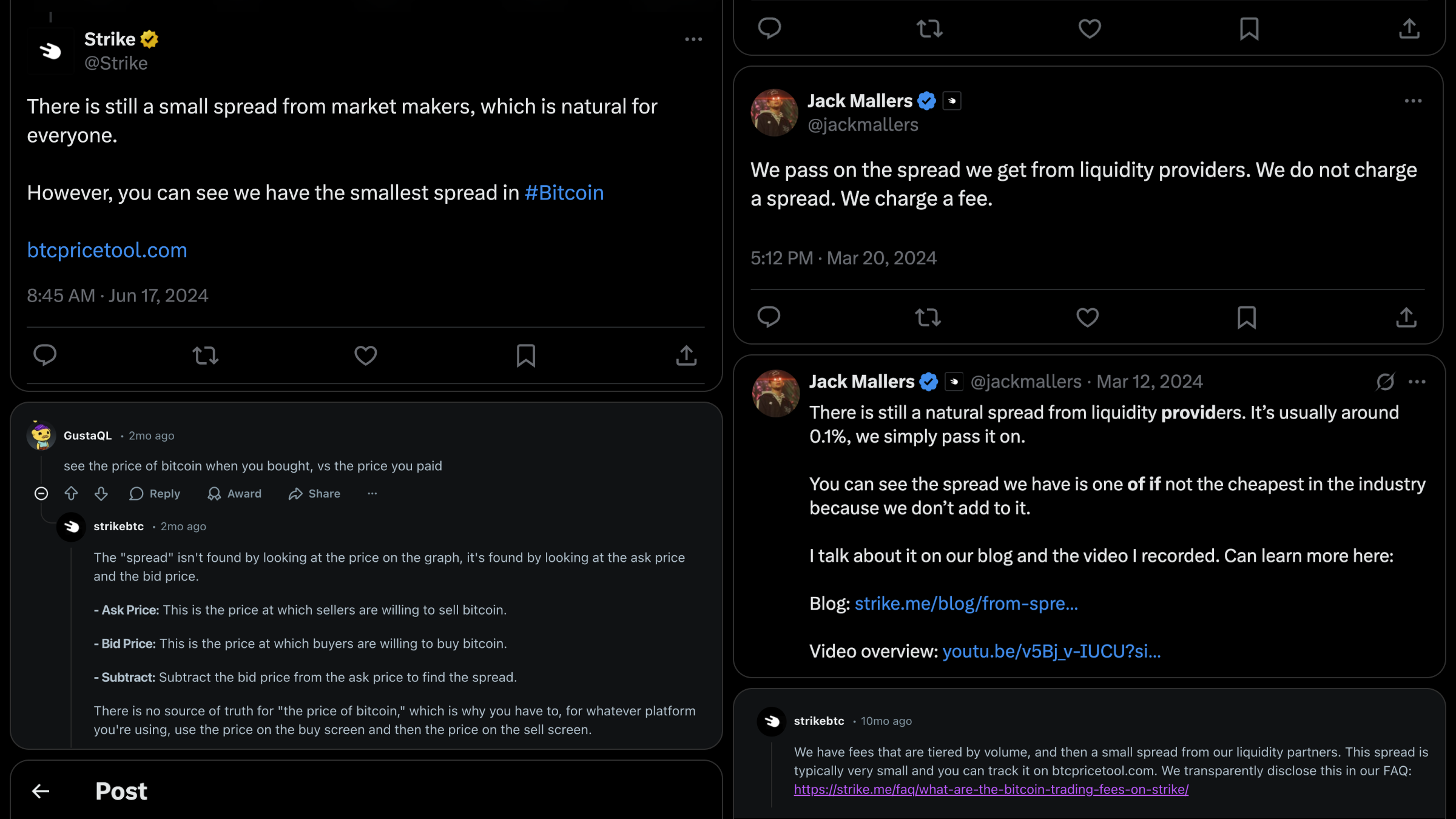

Does Strike charge any hidden fees or artificial spreads?

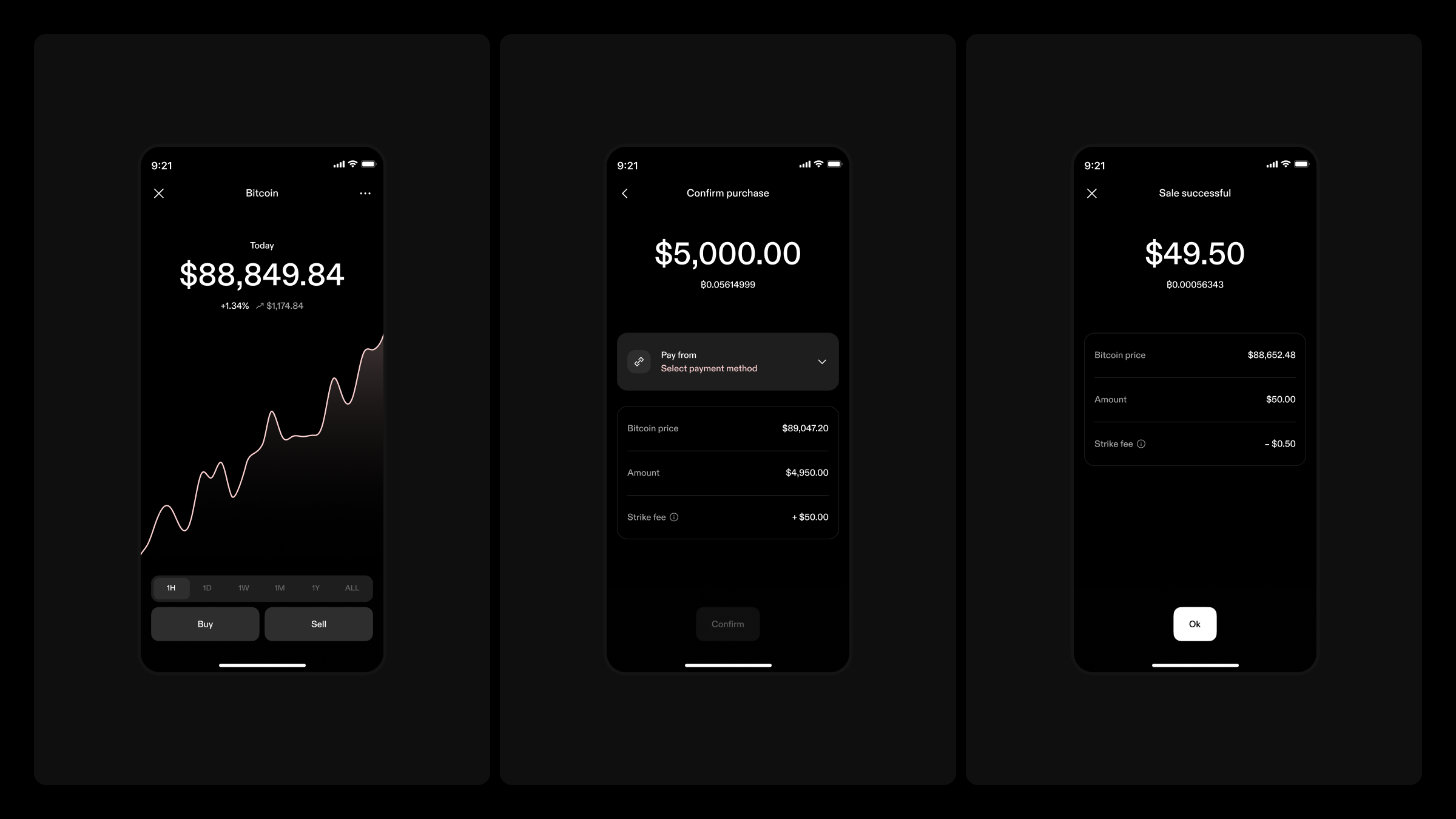

We transitioned to our current tier-based fee structure in February 2024. Since then, the fees you pay are displayed on the confirmation screen before you confirm a trade.

If you tap to buy and see $89,047.20, and tap to sell and see $88,652.48, that’s expected. We regularly request live quotes from our liquidity partners and offer the best possible prices. The $394.72 gap between them is not a fee charged by Strike.

Providing liquidity isn’t free. The buy price is always higher than the sell price because this spread allows liquidity providers to fund their operations and be available as a counterparty for your trades at any time. These firms operate sophisticated infrastructure, manage inventory risk, and quote prices across dozens of regions and currencies. They make money by quoting a spread: selling bitcoin slightly above the price at which they’re willing to buy it. That spread is their revenue for making markets efficient and reliable at scale.

Why does Strike show different Bitcoin prices on various screens?

Bitcoin doesn’t have a single, global price. You buy at the price a seller is willing to offer, and you sell at the price a buyer is willing to pay. Strike’s role is to ensure you’re always matched with the liquidity provider willing to sell to you at the lowest price or buy from you at the highest price. Whether you’re buying or selling, we’re constantly searching for the most competitive quotes we can find. That way, you get more sats for every dollar you spend, and more dollars for every sat you sell.

When you first open Strike, you might buy or sell bitcoin, but we don’t know which. To avoid confusion, we show a single midpoint price on the home screen: the average of the best buy and sell quotes we get from our liquidity partners.

For example, if the best buy quote is $89,047.20 and the best sell quote is $88,652.48, the midpoint is $88,849.84. When you actually tap Buy or Sell, you’ll see the real quote for that action. In this example, that means only a $197.36 move from the homepage price in either direction, instead of a full $394.72 swing. Showing the midpoint keeps the homepage neutral, consistent, and easier to understand.

How smart order routing provides better prices to Strike customers

Strike has invested in integrating with multiple high-quality liquidity providers to ensure redundancy and competitive execution. However, during periods of high volatility, buy-side and sell-side demand can become unbalanced. When more people want to buy than sell (or the opposite), the bid/ask spread naturally widens throughout the entire market. Neither Strike nor our liquidity providers are “profiting more” during these times. This is simply how market microstructures behave under stress.

Wider spreads can materially affect user experience: a buyer trying to “catch the dip” may suddenly see bitcoin priced thousands of dollars higher than someone selling at the same time. This is a problem we set out to reduce.

With our new smart order routing system, every time you place a buy order, we request a real-time quote from each of our connected liquidity providers. Conceptually, we’re asking each one: “A user wants to buy $100 of bitcoin. How many sats can you deliver right now?”

Each provider responds with a quote, and those quotes are often different. Smart order routing automatically selects the best quote (the one that gives you the highest number of sats per dollar) and executes your trade against that venue. The same logic applies when you sell: we choose the provider offering the highest price for your bitcoin.

We’ve effectively created real competition among our liquidity providers. Those quoting wide spreads will naturally lose flow to providers offering tighter markets. As a result, spreads should compress over time, and you’ll see better pricing on both buys and sells.

This system improves execution quality in both calm markets and high-volatility conditions, reducing the impact of temporary liquidity imbalances and ensuring you always get more bitcoin for your cash.

Smart order routing is enabled for all our fiat and USDT trading pairs. It provides you with the best quote not only when you buy or sell but also when you pay bills with bitcoin or convert part of your salary through a direct deposit. There is nothing you need to do to enable it, and we don’t charge you anything extra for it. There are no gimmicks, tricks, schemes, or artificial spreads, just a healthy obsession with delivering you as many sats as we possibly can whenever you need them.

How Strike improves trading prices, redundancy, and reliability

Smart order routing is one part of a broader effort. We’re continually exploring new ways to improve execution quality: expanding our network of high-quality liquidity providers, adding new regions and payment methods, and building features that help you grow your strategic reserve.

Strike has come a long way. In our earliest days, we relied on simple, single-path integrations that could be brittle under load or during market volatility. Over the years, we’ve evolved those systems into one of the most robust trading engines in the industry: fault-tolerant, globally distributed, and capable of sourcing competitive prices across multiple venues in real time. Exchange is core to our mission, and as long as our users care about acquiring bitcoin efficiently, we’ll continue investing heavily in making it faster, more reliable, and more cost-effective.

If you haven’t bought Bitcoin with Strike yet, give it a try. If building systems like this sounds exciting to you, we’re hiring. Check out our open roles and consider joining the team.