--

We’re excited to announce that bitcoin-backed loans are now available in Argentina, Brazil, Costa Rica, El Salvador, South Korea, and New Zealand (businesses only), with more countries coming soon.

We recently launched Virtual USD Accounts in 60+ countries, making it easier and more affordable than ever to move money into and out of Strike using bitcoin. Today, we’re taking it a step further: bitcoin-backed loan access is now officially expanding globally beyond the United States.

This marks another major milestone in our mission to deliver a seamless global Bitcoin experience, and adds to our growing suite of features built for users around the world.

You shouldn’t have to sell your bitcoin to access your wealth. Now, you don’t have to.

Introducing Bitcoin-Backed Loans Globally

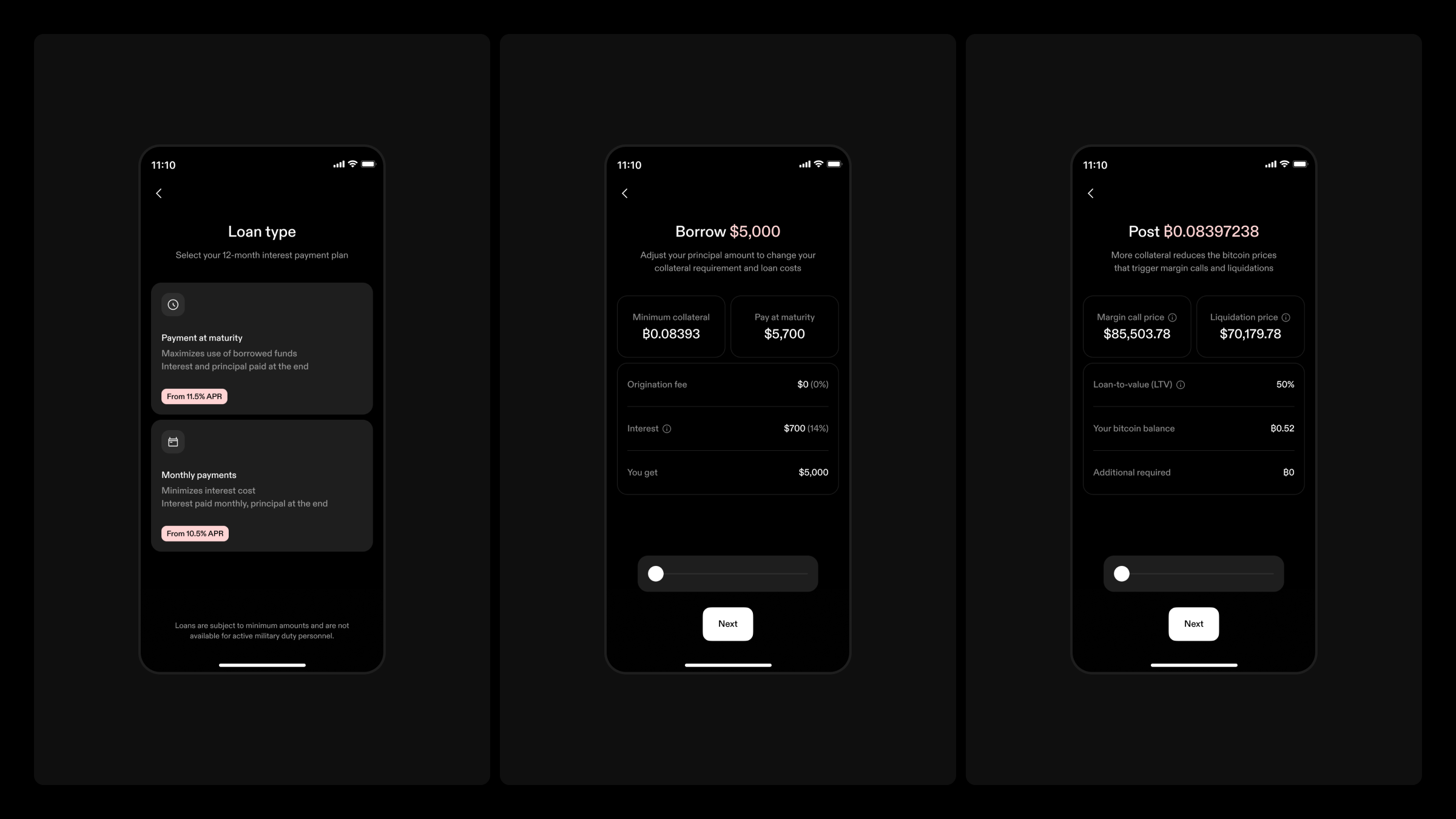

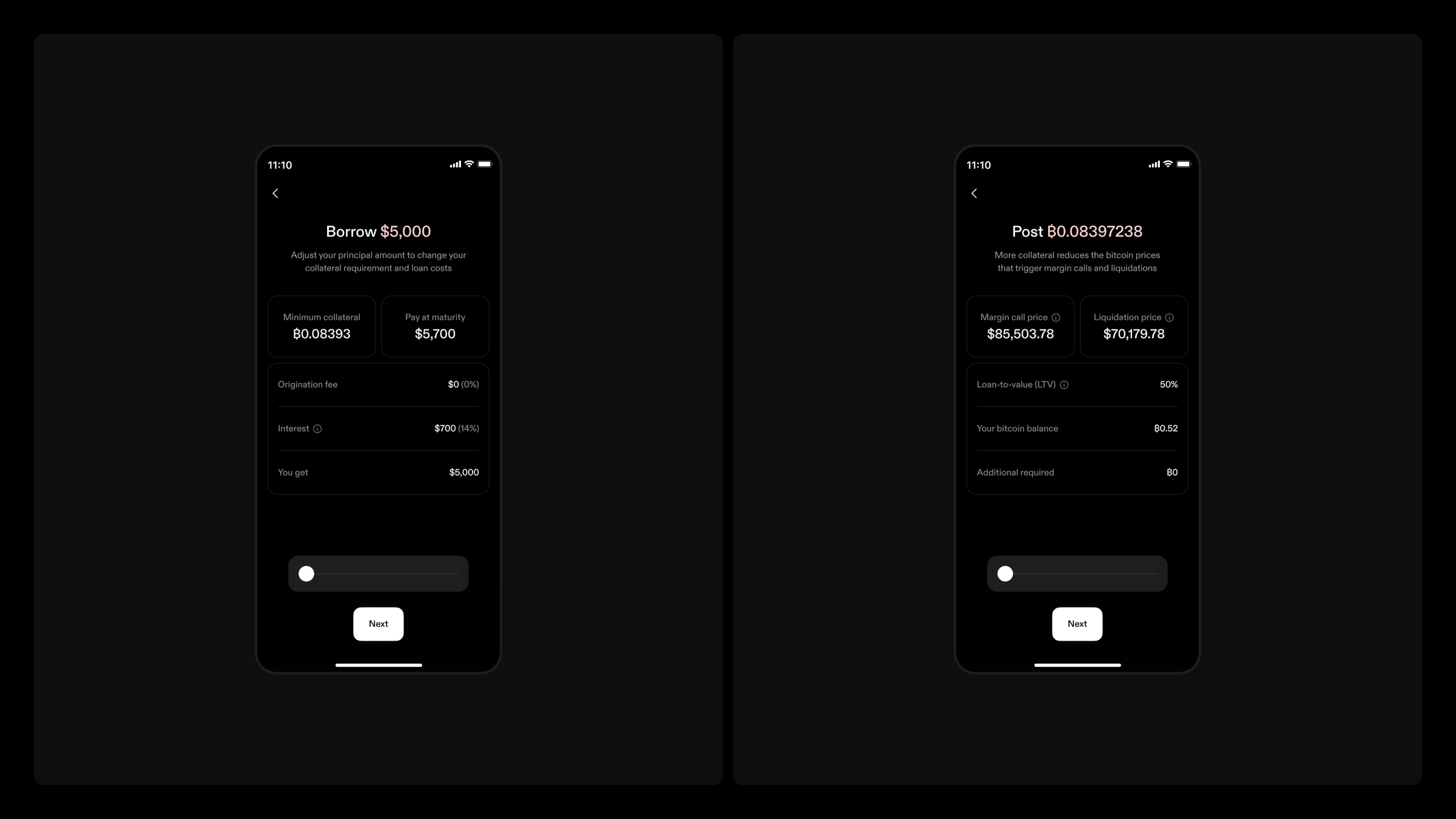

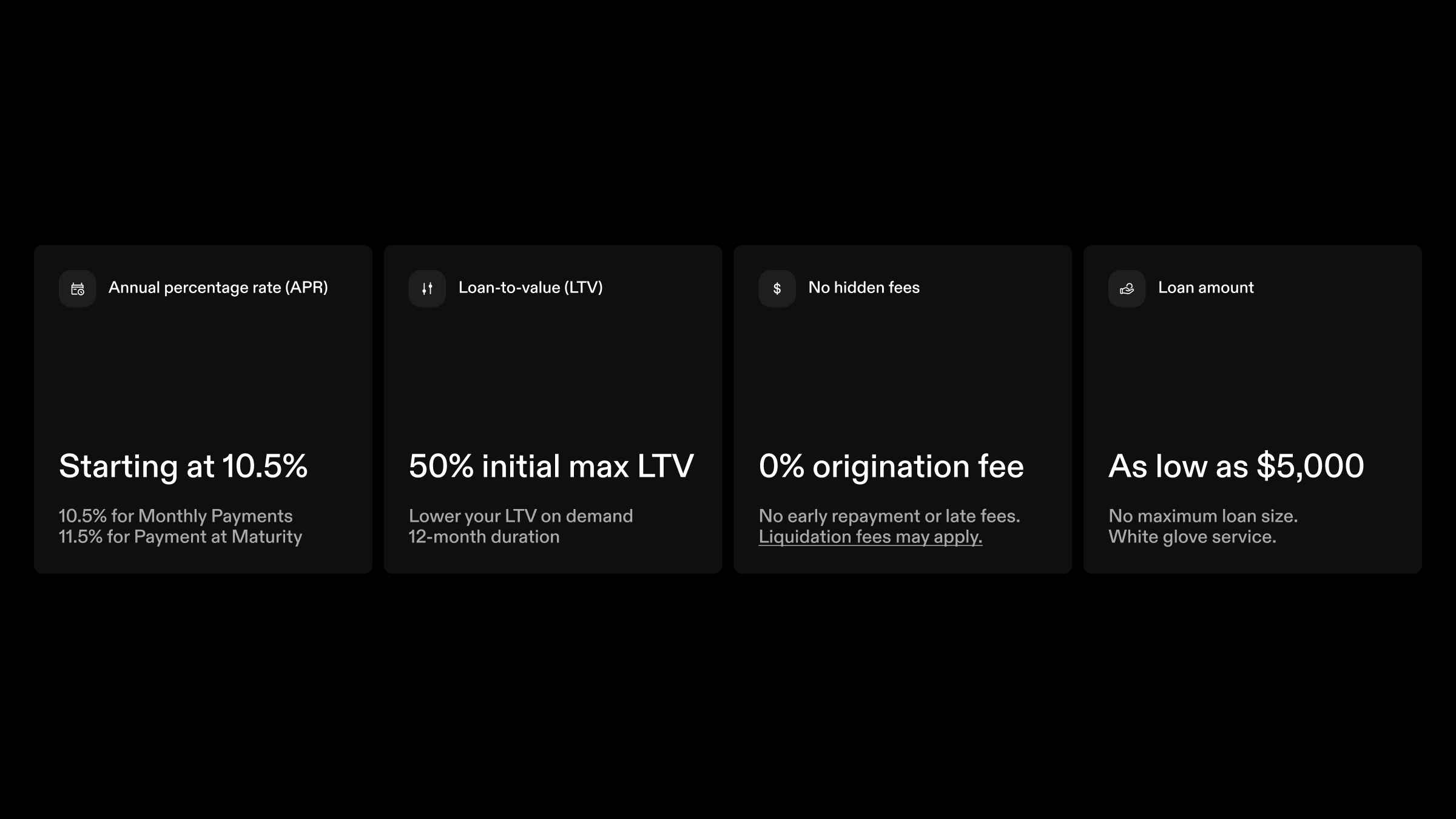

Strike now offers bitcoin-backed loans to eligible customers in select global regions, giving you a simple way to unlock your bitcoin’s buying power without selling. Get access to cash using your bitcoin as collateral with fast, flexible loans at market-leading terms. Open a loan from $5,000 for up to 12 months. Rates start at 10.5% APR with no origination and no early repayment fees.

The experience is designed for Bitcoiners, fast, simple, and intuitive. Post your bitcoin as collateral, receive cash, repay with interest, and get your bitcoin back, all within the Strike app. Easily monitor your loan and manage your collateral every step of the way.

Whether you’re buying a home, investing in your business, or funding your next move, bitcoin-backed loans turn long-term holdings into real-world utility, without giving up your stack.

Why borrow against your bitcoin?

- Keep your bitcoin: Stay exposed to future upside while accessing cash today.

- Mitigate taxable impact: Bitcoin-backed loans typically aren't taxed, but situations like loan liquidations or repaying with bitcoin can trigger taxable events.

- No credit checks: Approval is based on your bitcoin collateral, not your credit score.

- Fast access to funds: No lengthy approval processes or appraisals.

Learn more about bitcoin-backed loans.

Unlock your bitcoin’s buying power

Borrow against your bitcoin at market-leading terms

Get a bitcoin-backed loan from $5,000 for up to 12 months. Rates start at 10.5% APR with no origination fees and no early repayment fees. Pay interest monthly or at maturity, and add collateral anytime to lower your LTV. Easily customize your loan inside the app. Your bitcoin, your terms. Learn more.

To access loans greater than $5 million, reach out to our white-glove team at private@strike.me.

Open a loan in minutes

Apply directly in the Strike app, select your terms, and get approved in minutes. Cash is credited instantly and available to withdraw within a few business days. No credit check required. Whether you’re opening a loan for yourself or your business, we’ve got you covered. Learn more.

Manage your loan with ease

Strike’s Loan Center puts you in control. Track your loan health, get real-time alerts, and access priority support, all from the app. Learn more.

Your bitcoin, securely held

When you open a loan, your bitcoin collateral is held by Strike or transferred to one of our trusted capital providers, where it is securely held and not re-hypothecated. Learn more.

Open multiple loans

Open up to five bitcoin-backed loans at a time. Multiple loans give you greater flexibility and control. Borrow for different goals, access more liquidity, and manage each loan independently. Learn more.

Stay invested in bitcoin’s future

Selling bitcoin means giving up long-term upside and potentially triggering a taxable event. Bitcoin-backed loans let you stay invested while unlocking the value you’ve built. Whether you’re buying a home, investing in your business, or funding your next move, bitcoin-backed loans let you tap into your wealth without giving up your stack.

Get a bitcoin-backed loan

Bitcoin-backed loans are now available to eligible customers in select regions. If you're eligible, you’ll see the Bitcoin-backed loans card in your app’s Cash tab. Tap it to get started.

Not seeing the card yet? Make sure your app is updated and your account is fully verified.

Prior to opening a loan, check out our FAQs to familiarize yourself with how bitcoin-backed loans work, including the Loan-to-Value (LTV) ratio, how payments work, and margin calls and liquidations.

Got a bitcoin-backed loan elsewhere but interested in moving to Strike? Reach out to our white glove team at private@strike.me for personalized support.