Today, we’re excited to announce that refinancing is now available for bitcoin-backed loans on Strike.

With this new feature, you can refinance an existing loan into a new one with updated terms, and keep borrowing against your bitcoin without friction. All with no refinancing fee.

Introducing Refinancing

Refinancing gives you greater flexibility in managing your loan. Here’s what refinancing makes possible:

Refinance your loan

At the end of your loan term, you can choose to refinance your loan directly in the Strike app. Your existing loan’s principal is paid off using the new loan’s proceeds and collateral is applied to your new loan. You’ll only repay interest accrued to date.

Unlock updated terms

Easily refinance into a new loan with updated terms at no cost. Refinanced loans start a fresh 12-month term with Strike’s latest terms, including the interest rate.

Keep your bitcoin

Stay invested in bitcoin while unlocking cash when you need it. Refinancing ensures you can continue HODLing, while still accessing your wealth on your terms.

Refinance your loan

Refinancing is now available to Strike Lending customers, including businesses, with eligible loans. You can refinance your bitcoin-backed loan if:

- Your loan has been open for more than 60 days

- Your Loan-to-Value (LTV) ratio is 50% or lower

- Your remaining principal is above the minimum loan amount

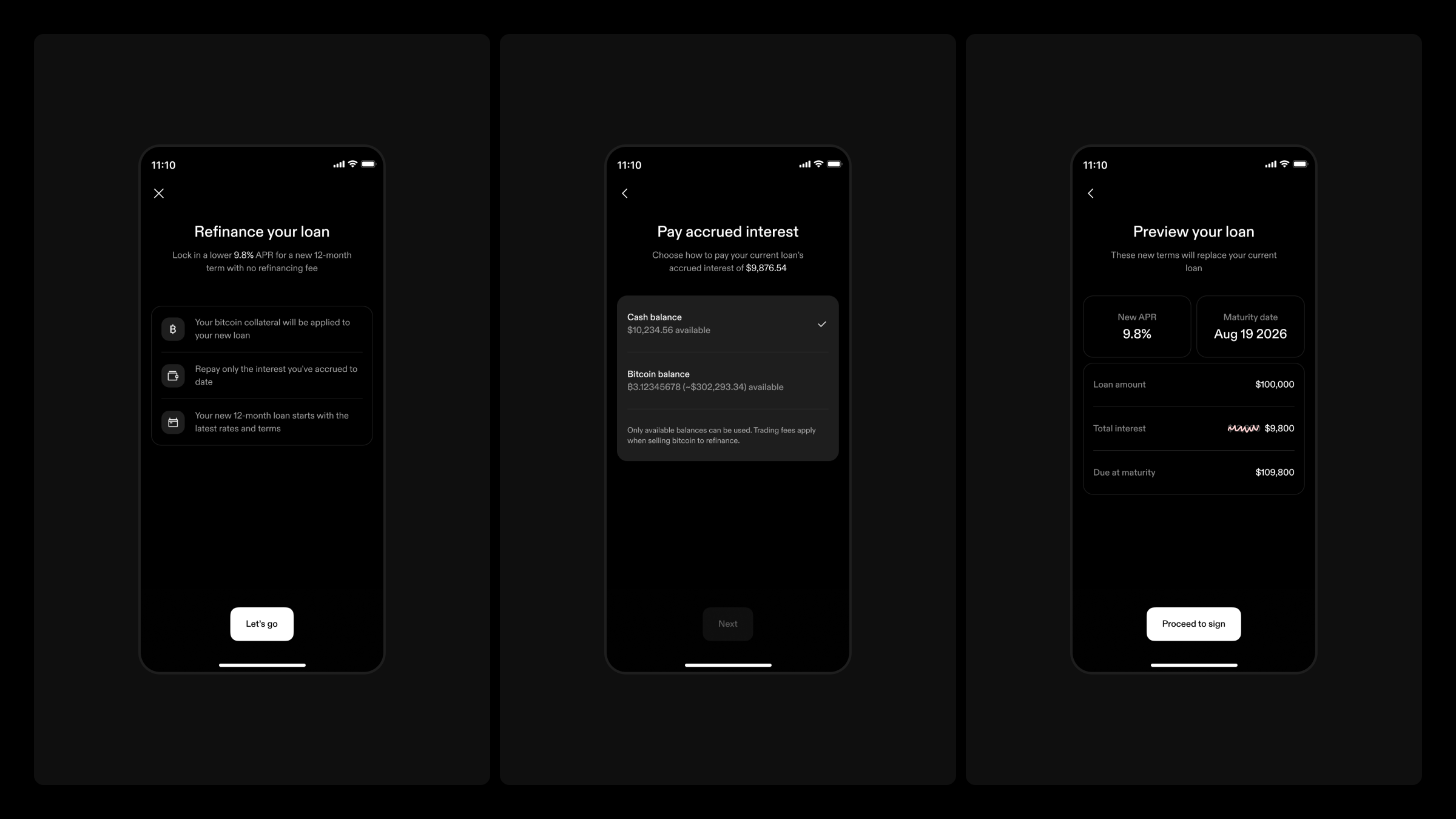

Strike makes it easy to refinance your loan, directly in the Strike app. To refinance your loan, simply follow these steps:

- Tap your LTV Tracker to open your Loan Center

- Scroll down and tap “Refinance your loan”

- Pay any accrued outstanding interest

- Review and sign your new agreement

Once confirmed, your refinanced loan begins immediately with updated terms.

Log in to your Strike app and see if your loan is eligible for refinancing. For more details about refinancing, check out our FAQ.

The best place to borrow against your bitcoin

At Strike, we’ve built bitcoin-backed loans to be fast, flexible, and secure, so you can access cash when you need it without selling your bitcoin.

We’ve designed every detail around your needs:

- Market-leading terms: Rates starting at 9.5% APR, 0% origination fee, loans starting at $5K, with no maximum. Availability and terms vary by region.

- Fast access to funds: Open a loan in minutes and receive cash within one business day. No credit check required.

- Flexible options: Dynamic collateral, flexible repayment, refinancing, and the ability to open up to 5 loans at once.

- Seamless experience: Open and manage your loan directly in the Strike app. Track loan health in real time, get alerts, and request support in-app.

- No rehypothecation: Your bitcoin is held by Strike or transferred to one of our trusted capital providers, where it is securely held in a segregated wallet and not re-hypothecated.

For white-glove support with large loan amounts, reach out to our Private client concierge at private@strike.me.

More information about Strike Lending can be found in our FAQs.